Learning Objectives

- Understand the concept of equity index valuation and the importance of Fair Value (FV) in trading.

- Familiarise with the index producer, composition, and types of equity indices.

- Learn the factors affecting FV, including dividend forecasting and interest rates.

- Grasp the events affecting FV, such as rebalancing.

- Gain knowledge on equity index arbitrage and inter-index correlation.

Learning Outcomes

Upon completion of this module, apprentices will be able to:

- Apply the concept of equity index valuation to identify profitable trading opportunities.

- Analyse the factors affecting FV and their impact on equity index valuation.

- Utilise equity index arbitrage techniques for profitable trades.

- Recognise the implications of inter-index correlation on trading decisions.

Learning Objectives

- Understand how to apply equity index valuation in practical trading scenarios.

- Learn about market microstructure and flow analysis.

- Master common strategies of trading the equity index calendar spreads.

- Explore arbitrage between synthetic and exchange-listed spreads.

- Study directional trading of calendar spreads and mean-reversion trading.

- Comprehend inter-product pairs trading.

- Learn about portfolio management and managing currency exposure with currency futures.

Learning Outcomes

Upon completion of this module, apprentices will be able to:

- Implement equity index valuation techniques in real-world trading situations.

- Employ market microstructure and flow analysis to make informed trading decisions.

- Develop and execute various calendar spread strategies.

- Identify arbitrage opportunities between synthetic and exchange-listed spreads.

- Manage their portfolio effectively and hedge currency exposure using currency futures.

Learning Objectives

- Understand the characteristics of commodities and their respective futures contracts.

- Learn the fundamental considerations when trading commodity futures.

- Study market microstructure and flow analysis for commodity trading.

- Master common strategies of trading the commodity calendar spreads.

- Explore trading the term structure and seasonal structure of commodities.

- Gain knowledge on inter-product pairs trading for commodity futures.

- Learn about portfolio management and managing currency exposure with currency futures.

Learning Outcomes

Upon completion of this module, apprentices will be able to:

- Analyse the fundamental factors affecting the commodity futures market.

- Apply market microstructure and flow analysis in commodity trading decisions.

- Execute various commodity calendar spread strategies to capitalise on market opportunities.

- Employ term structure and seasonal structure analysis for improved trading performance.

- Utilise inter-product pairs trading techniques to diversify their commodity trading portfolio.

- Manage their portfolio effectively and hedge currency exposure using currency futures.

Learning Objectives

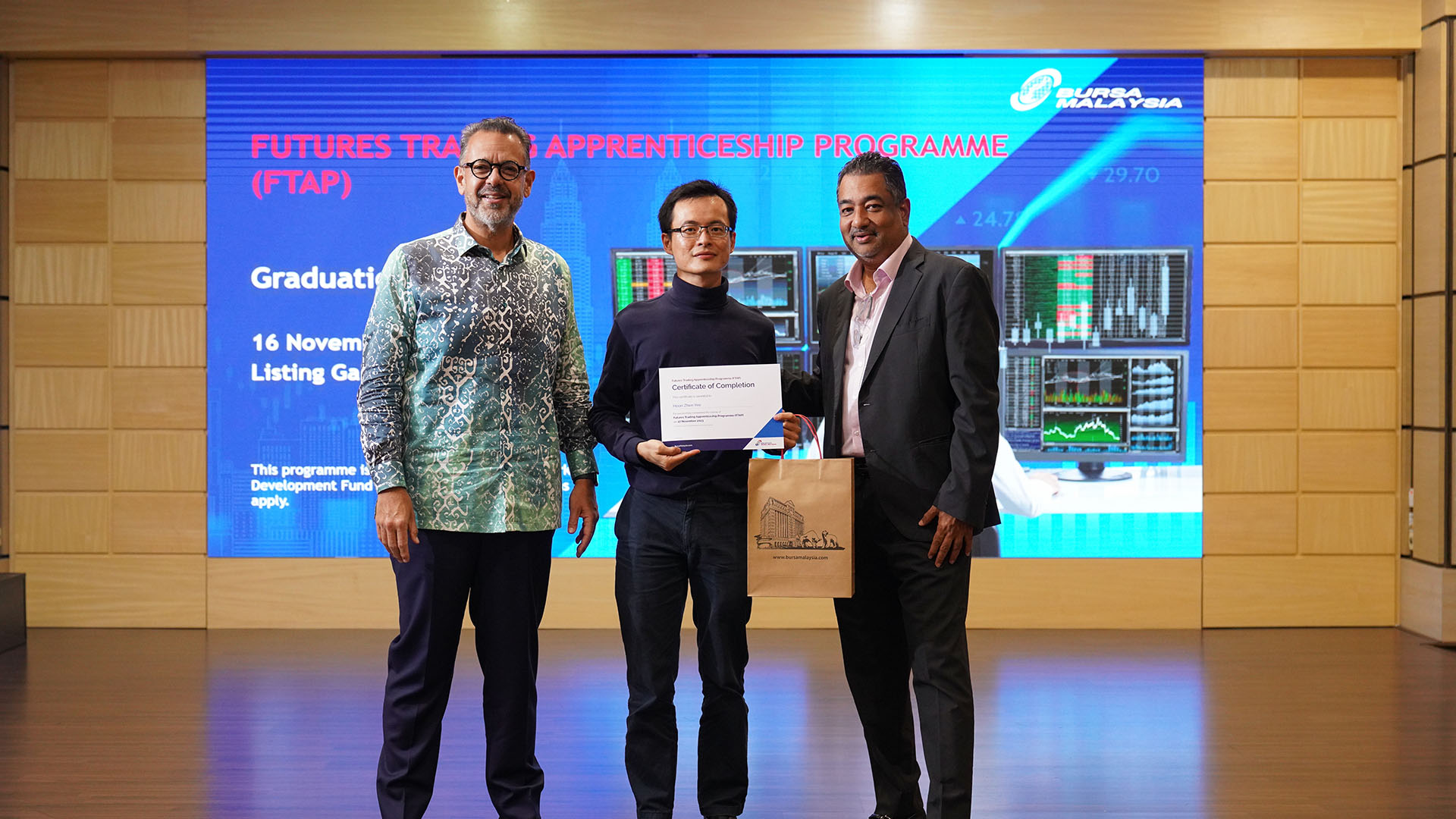

- Experience the daily routine of a professional trader.

- Learn about advanced trading systems and tools.

- Understand the importance of setting up a professional trading environment.

- Practice trading under the guidance of seasoned traders in simulated live market conditions.

Learning Outcomes

Upon completion of this module, apprentices will be able to:

- Apply the knowledge and skills acquired from Modules 201-203 in a simulated live trading

environment.

- Utilise advanced trading systems and tools for improved trading performance.

- Develop the ability to make informed trading decisions under the guidance of experienced traders.

- Demonstrate proficiency in various trading strategies, including calendar spread strategies,

inter-market spread

strategies, and synthetic spreads.