A content collaboration between Multiply and Bursa Malaysia

3 things to know about investing in Exchange Traded Funds (ETFs)

Exchange traded funds (ETFs) are similar to unit trusts, as they are also a basket of securities (like shares) which you can buy or sell on Bursa Malaysia. But, unlike unit trusts, you can buy or sell ETFs directly on Bursa Malaysia without needing an agent. ETFs track indices (made up of baskets of shares or bonds) or the value of commodities (like gold or palm oil), and you can diversify your investments just by buying one ETF.

If you’re interested to invest in ETFs, watch this video on 3 things to know about investing in ETFs:

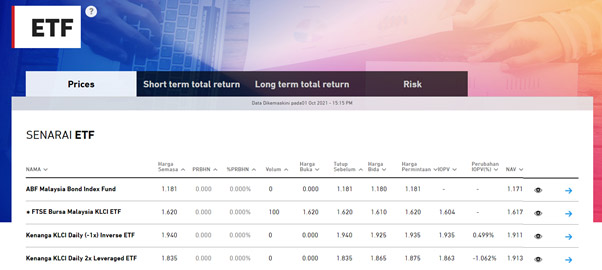

To learn more about ETFs and find out about the ETFs listed on Bursa Malaysia and their performance, klik di sini. As the screenshot below shows, you’ll be able to see the prices of the ETFs, as well as its returns over the long (over 1, 3, 5 and 10 years) and short (over 1 day, 1 week, 1 month, 3 months and 6 months) term:

In general, you should look to invest in ETFs that have shown a stable or positive performance over the long term. But remember, past performance doesn’t guarantee future returns! So, if you can afford it, try to invest in different types of investments too, like fixed deposits, real estate investment trusts (REITs) or unit trusts. This way, you can reduce the risk of losing all your money if your investments don’t perform well.

To learn about the basics of investing, read Multiply’s guide on Investing 101. And if you’re interested to learn more about ETFs, you can also read Multiply’s guide here.